Key Takeaways

o The role of bonds in a portfolio is generally either to produce income or to help manage volatility.

o Today’s yields on bonds are significantly higher than the past few years and offer a great alternative for portfolios given 85% of total return is driven by the income it produces.

o Bonds continue to offer lower volatility than other yield producing asset classes and tend to zig when equities zag helping to lower portfolio volatility.

As the Federal Reserve increased rates from less than 1% up to 5%, the bond market experienced a significant fall. In fact, the Bloomberg U.S. Aggregate (the common index that represents the broad bond market) experienced its largest drawdown not only in magnitude but also in duration since its inception¹ and still has a long way to go for a full recovery.

Bonds Role

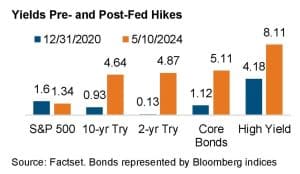

Bonds tend to play one of two key roles in a portfolio – either providing income or helping to manage portfolio risk. Over the past several years, we’ve seen bond yields significantly increase, as shown in the chart.

But what if the Federal Reserve increases rates instead? These higher yields also offset any

potential negative impact from rate increases. An increase of 1% in interest rates would expect to

see less than a 1% fall in total return. It was a significantly different experience than what we

saw in 2022.

Bonds Volatility

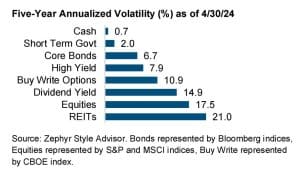

The Move index is a measure of short-term bond volatility–its bonds equivalent of VIX. In the past three years, the index has consistently been above its prior all-time high seen in 2020 (COVID-19 pandemic), running at 2.5 times its long-term average.³ Despite running at higher levels of volatility, though, why are we still seeing money flow into bonds? The reason for this is that in addition to the higher yield, bonds still offer a lower volatility option relative to other asset classes, as shown below.

On top of continuing to provide a lower level of volatility, we’ve also seen bonds correlation to equities move back to a more normal relationship (when bonds perform well, stocks underperform, and when bonds perform poorly, stocks do well). This should allow bonds to zig more when equities zag and help to manage total portfolio risk.

Bonds as Ballast

Bonds are a critical component of a diversified portfolio, providing ballast when times get rocky. A higher yield today allows them to provide greater stability and help to reduce overall portfolio volatility. But the key to consider is to diversify that bond exposure as not all bonds are created equal and spreading out the bets will help limit the exposure to not only the equity bear but also the bond bear.

¹Source: JPMogran Guide to the Markets

²Source: “The Worst Bond Bear Market Ever Marches On,” Ben Carlson, May 5, 2024

³Source: AssetMark, Bloomberg

Centrus Financial Strategies

Financial planning and investment advisory services offered through Prosperity Capital Advisors

(PCA), an SEC registered investment advisor. For more information, please visit

www.adviserinfo.sec.gov.

Information Provided by:

AssetMark, Inc.

1655 Grant Street 10ᵗʰ Floor

Concord, CA 94520-2445

800-664-5345